Commercial real estate investing can be a lucrative and rewarding way to diversify your portfolio and generate passive income. However, finding a good commercial property to invest in is not as easy as it sounds. There are many factors to consider, such as location, property type, market conditions, financing options, tenant demand, and potential returns.

In this blog post, we will share some tips and steps on how to find a good commercial property to invest in. We will also cover some common mistakes to avoid and some tools and resources to help you along the way.

Determine your investment goals and strategy

Before you start looking for properties, you should have a clear idea of what you want to achieve with your investment and how you plan to do it. For example, are you looking for cash flow or capital appreciation? Are you interested in a specific property type, such as office, retail, industrial, or multifamily? Are you willing to take on more risk or prefer a more stable investment?

Having a clear vision of your investment goals and strategy will help you narrow down your options and focus on the properties that match your criteria. You should also consider your budget, time horizon, risk tolerance, and exit plan.

Some of the common investment strategies for commercial real estate are:

Buy and hold: This strategy involves buying a property and holding it for a long period of time, usually more than five years. The main goal is to generate steady cash flow from rents and benefit from appreciation over time. This strategy is suitable for investors who have a long-term perspective and can afford to tie up their capital for a while.

Fix and flip: This strategy involves buying a property that needs renovation or improvement, fixing it up, and selling it for a profit in a short period of time, usually less than a year. The main goal is to capitalize on the value-added potential of the property and take advantage of favorable market conditions. This strategy is suitable for investors who have access to financing, contractors, and buyers, and can manage the risks and costs involved.

Value-add: This strategy involves buying a property that is underperforming or undervalued, making some improvements or changes to increase its income or value, and either holding it for cash flow or selling it for a profit. The main goal is to create value through active management and optimization of the property. This strategy is suitable for investors who have experience in commercial real estate, can identify opportunities for improvement, and can execute the plan effectively.

Do your market research

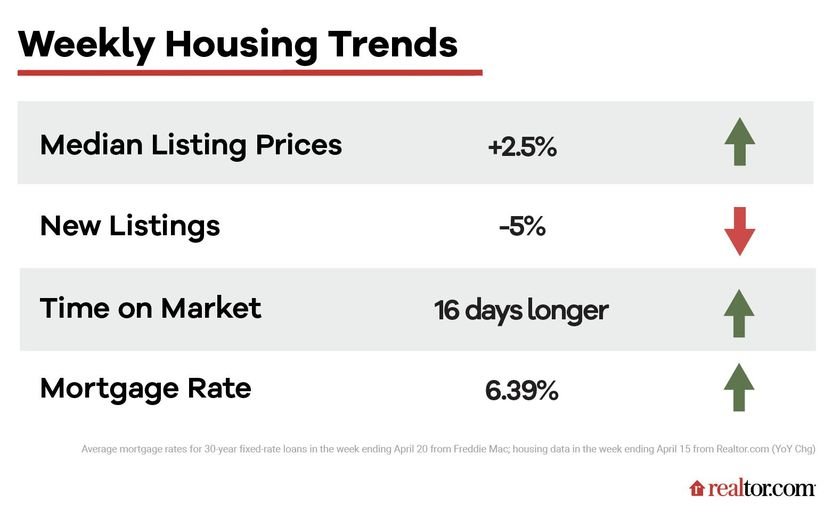

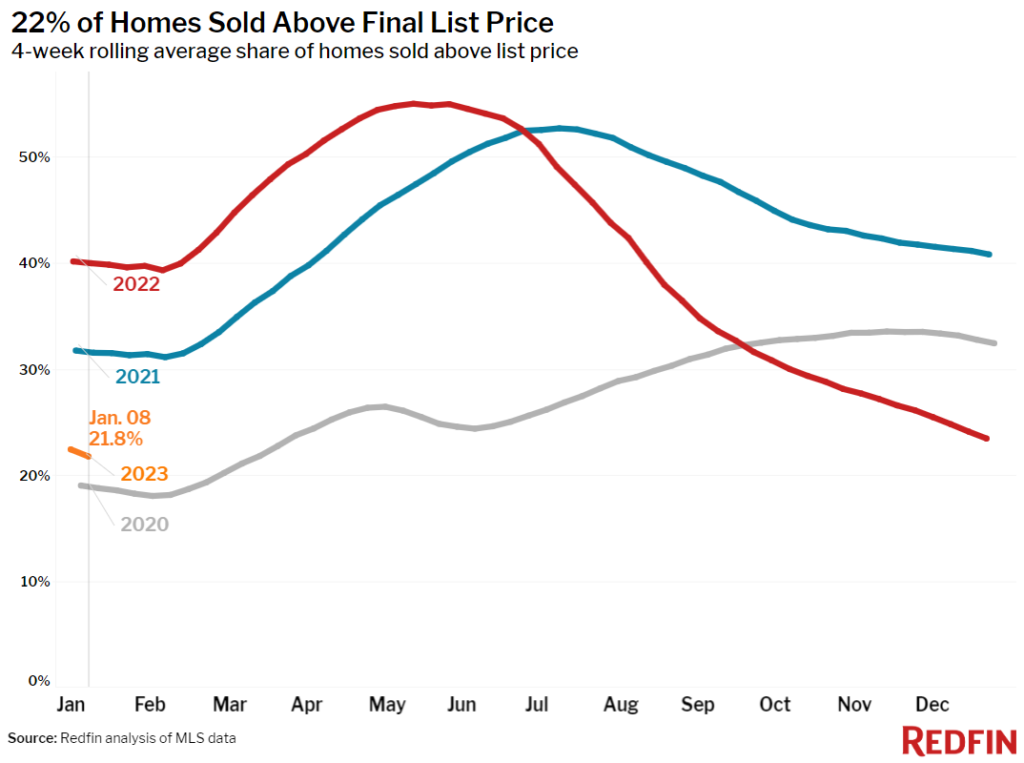

Once you have an idea of what kind of property you are looking for, you should research the market conditions and trends in the area where you want to invest. You should look at factors such as supply and demand, vacancy rates, rental rates, occupancy rates, absorption rates, cap rates, and price trends. You should also analyze the economic and demographic factors that affect the demand for commercial real estate in the area, such as population growth, income levels, employment growth, business activity, infrastructure development, and consumer spending.

Doing your market research will help you identify the best locations and submarkets to invest in and avoid overpaying or investing in a declining market. You can use various sources of data and information to conduct your market research, such as:

Online platforms: There are many online platforms that provide data and insights on commercial real estate markets, such as LoopNet , CoStar , CREXi , Reonomy , Real Capital Analytics , CBRE , JLL , Cushman & Wakefield , etc. You can use these platforms to search for properties, compare prices, analyze trends, and access reports.

Brokers and agents: Brokers and agents are professionals who specialize in commercial real estate transactions. They can help you find properties, negotiate deals, provide market knowledge, and connect you with other professionals. You can find brokers and agents through online directories, referrals, or networking events.

Local sources: Local sources are people or organizations that have firsthand knowledge or experience in the local commercial real estate market. They can include property owners, tenants, managers, developers, investors, appraisers, inspectors, lawyers, accountants, etc. You can find local sources through word-of-mouth, online forums, social media, or industry associations.

Find potential properties

After you have done your market research, you can start looking for potential properties that meet your investment goals and strategy. You can use various sources to find commercial properties for sale or lease, such as:

Online platforms: As mentioned above, online platforms are useful tools to search for properties based on various criteria, such as location, property type, size, price, cap rate, etc. You can also filter by availability, condition, tenancy, and other features. Some of the online platforms also offer alerts, notifications, and analytics to help you stay updated on the market.

Brokers and agents: Brokers and agents can also help you find properties that match your criteria and budget. They can leverage their network, database, and expertise to source deals that may not be listed online or publicly. They can also arrange property tours, provide due diligence materials, and facilitate the transaction process.

Direct marketing: Direct marketing is a strategy that involves reaching out to property owners or sellers directly and expressing your interest in buying their property. You can use various methods to contact them, such as phone calls, emails, letters, or postcards. You can also use online tools to find their contact information, such as Reonomy , PropertyRadar , or Skip Genie . Direct marketing can help you find off-market deals that have less competition and more room for negotiation.

Analyze the properties

Once you have a list of potential properties, you should analyze them in detail and compare them based on their financial performance and potential returns. You should use various tools and methods to evaluate the properties, such as:

Income statements: Income statements are documents that show the income and expenses of a property over a period of time, usually a year. They can help you calculate the net operating income (NOI) of a property, which is the income after deducting all operating expenses (but not debt service or taxes). NOI is an important indicator of a property’s profitability and cash flow.

Cash flow analysis: Cash flow analysis is a process of projecting the future cash flows of a property based on various assumptions and scenarios. It can help you estimate the cash-on-cash return (COC) of a property, which is the annual cash flow divided by the initial investment. COC is a measure of how quickly you can recoup your investment from the cash flow.

Net operating income (NOI): NOI is the income after deducting all operating expenses (but not debt service or taxes) from a property. NOI is an important indicator of a property’s profitability and cash flow.

Capitalization rate (cap rate): Cap rate is the ratio of NOI to the property value. Cap rate is a measure of how much income a property can generate relative to its value. It can also be used to estimate the value of a property based on its NOI and market cap rate. Cap rate is inversely related to value: the higher the cap rate, the lower the value, and vice versa.

Internal rate of return (IRR): IRR is the annualized rate of return that equates the present value of a property’s future cash flows with its initial investment. IRR is a measure of how much return a property can generate over its holding period. It can also be used to compare different investment options based on their risk-adjusted returns.

Return on investment (ROI): ROI is the ratio of the net profit from a property to the initial investment. ROI is a measure of how much profit a property can generate relative to its cost. It can also be used to compare different investment options based on their profitability.

You should also consider the risks and challenges associated with each property, such as environmental issues, zoning regulations, legal disputes, tenant turnover, competition, market fluctuations, and financing availability. You should also conduct a due diligence process to verify the accuracy of the information provided by the seller or broker and check for any hidden problems or liabilities with the property.

Make an offer and close the deal

After you have analyzed the properties and selected the one that best suits your investment goals and strategy, you can make an offer to the seller or broker. You should negotiate the best price and terms possible based on your analysis and market research. You should also secure financing for your purchase from a lender or investor that specializes in commercial real estate loans. You should also hire professionals such as lawyers, accountants, appraisers, inspectors, and contractors to help you with the closing process and ensure that everything goes smoothly.

Conclusion

Finding a good commercial property to invest in can be challenging, but rewarding. By following these tips and steps, you can increase your chances of finding a profitable and suitable property for your portfolio. You can also avoid some common mistakes that can cost you time and money.

If you need more help or guidance on finding a good commercial property to invest in, feel free to contact us at info@capitaldf.com. We are experts in commercial and residential real estate investing and we can help you fund the best deals in California. We look forward to hearing from you soon!